Student debt borrowers are not prepared for repayment

Photo by Sophia Novelo

Student debt is one of the many stressors affecting students and their families in their pursuit for education.

December 2, 2021

The United States has around $1.7 trillion in student loan debt as of this year and it is the second highest consumer debt category, higher than both auto and credit card loans. On average, the college graduate is responsible for paying off $30,000 in student loan debt individually, but the Biden Administration plans to aid borrowers with at least $10,000 to help ease the crisis.

“Receiving this kind of help would lessen the burden of having to worry and although I personally always try to manage the aid I’m given, it still becomes a lot with all the fees and different costs that come up,” said Alexander Atherly, a senior at Cal State San Marcos.

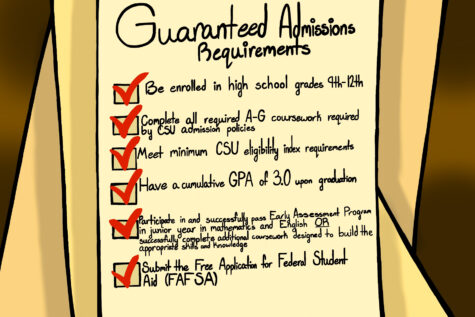

In this day and age, college is made out to be the most desirable path to take after highschool, which leads many people to take on debt for a degree they won’t end up using or needing. Seven out of ten college graduates leave school with loan debt, so as high school seniors prepare to apply for college and receive their financial aid packets in the spring, it’s important to understand the best options available to ensure they don’t become one of the unlucky seven.

“Personally I always had college in my mind, but now I’ve realized that I can just get a job based on what actually interests me,” senior Jack Lepine said.

Free money such as grants or scholarships should always be chosen first, but if extra aid is needed, federal loans are the next best thing. Specifically subsidized loans as the government will pay the interest that accumulates over time. 42.9 million Americans who have taken on student loan debt were more than likely unaware of this information.

“Honestly it really stresses me out having to pay for all of it on my own, but I know that scholarships and FAFSA will always be there and I just need to take advantage of them,” senior Jennifer Mai said.

If the cost of tuition follows the path it is on, a four-year degree will cost around $113k at a state school and $259k at a private school in five years. If financial literacy does not become an important issue in schools, this student debt crisis will continue on to future generations.